Overpaid Taxes Can Be Refunded In The Form Of A Tax Return. 12010 LAMBADA HAIL DSLAM NEVER MALAYSIA NOTICE TO CALL FOR INFORMATION UNDER SECTION 81 OF THE INCOME TAX ACT 1967 STATEMENT TO STRIKE OFF DEFUNCT COMPANY Name of Company full name of.

7 Tips To File Malaysian Income Tax For Beginners

A tax rebate reduces the amount of tax charged there are currently four types of tax rebates for income tax Malaysia YA 2021.

. Akta Lembaga Hasil Dalam Negeri 1995pdf. The CP38 notification is issued to the employer as supplementary instructions to clear the balance of tax liability of employees over and above the Monthly Tax Deductions MTD 30th June 2022 is the final date for submission of Form B Year Assessment 2021 and the payment of income tax for individuals who earn business income. Form CP22 is a report from the government issued by the LHDN and also a form for New Employee Notification.

Employer is not required to send notification using CP22 to the IRBM if. Youre eligible for an automatic tax deduction of RM9000 just by filling in the LHDN e-Filing form. Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file.

Find Out Which Taxable Income Band You Are In. Other income is taxed at a rate of 30. You can learn how to file your income tax in Malaysia using LHDN e-filing with.

Once you have filed all the relevant tax amounts charged on your chargeable income. Total income tax exemptions and reliefs chargeabletaxable income. Claiming these incentives can help you lower your tax rate and pay less in overall taxes.

So the more taxable income you earn the higher the tax youll be paying. The Income-Tax I-T department announced on Saturday 7 August 2021 that the central government has created three dedicated email addresses for income taxpayers to express issues relating to faceless tax assessments penalties and appeals. On the First 5000 Next 15000.

A calculation is done to determine if you have tax to pay or are indeed eligible for a rebate. On the First 5000. The new employee is not subject to income tax.

Also LHDN extended the dateline for extra 2 weeks. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. How To File Your Taxes Manually In Malaysia.

Tax Offences And Penalties In Malaysia. E-TT is a system that uses Virtual Account Number VA as payment identification. For a new taxpayer or existing taxpayer who would like to complete ITRF for the first time there are a few steps you have to complete prior to filling the ITRF form online through e-Filing.

Your tax rate is calculated based on your taxable income. Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file. How Does Monthly Tax Deduction Work In Malaysia.

In Malaysia tax residents are taxed based on a progressive tax rate ie. Under S4 of the Income Tax Act 1967 the following are classes of chargeable income. Tax rebate for Self.

Rate free form. Resident individuals are eligible to claim tax rebates and tax reliefs. Nonresidents are subject to withholding taxes on certain types of income.

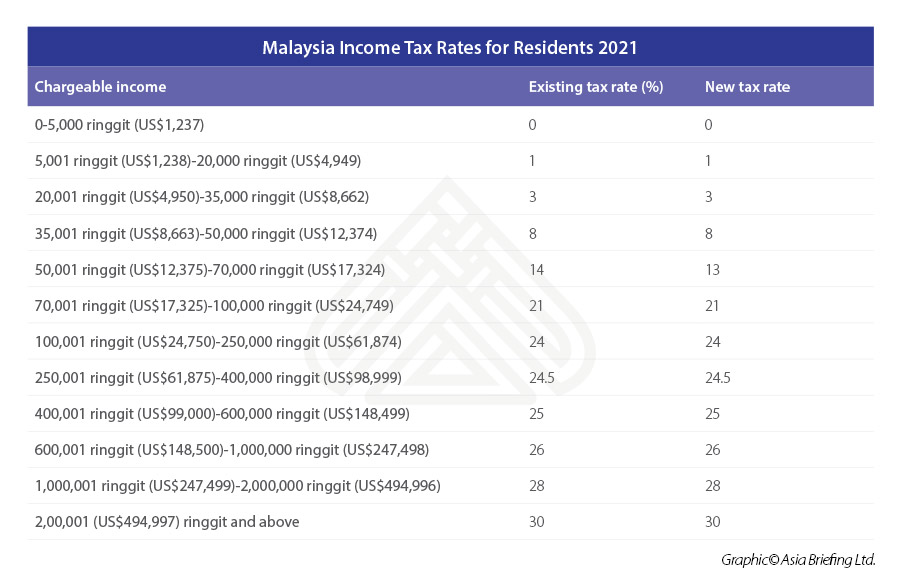

Personal Income tax is payable on the taxable income of residents at the progressive rates from 0 to 30 with effective Year of Assessment 2020. Guide To Using LHDN e-Filing To File Your Income Tax. The tax rate increase as your income increases and the tax rate is based on their chargeable income.

Income tax rates 2022 Malaysia. Self parents and spouse 1. Income Tax Act 1967 Withholding Tax-Rate Payment Form.

Guide To Using LHDN e-Filing To File Your Income Tax. Heres How A Tax Rebate Can Help You Reduce Your Tax Further. Fillable Online Form CP7 - Lembaga Hasil Dalam Negeri Fax Email.

Starting from 1 April 2022 LHDN has launched an online payment system e-TT for users to make tax payments. 1 Apr 2015. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others.

Calculations RM Rate TaxRM A. Income Tax Department Launches Dedicated Emails for Taxpayers Complaints. With that heres LHDNs full list of tax reliefs for YA 2021.

Residents and non-residents are subject to tax on Malaysian-source income only. Below are the Individual Personal income tax rates for the Year of Assessment 2021 provided by the The Inland Revenue Board IRB Lembaga Hasil Dalam Negeri LHDN Malaysia. The most important thing is you will get a faster refund in case you paid excess income tax through PCB.

Overpaid Taxes Can Be Refunded In The Form Of A Tax Return. How To Pay Your Income Tax In Malaysia. Per LHDNs website these are the tax rates for the 2021 tax year.

Tax Rate Lembaga Hasil Dalam Negeri Malaysia

Tax Rate Lembaga Hasil Dalam Negeri Malaysia

Types Of Taxes In Malaysia For Companies

Cukai Pendapatan How To File Income Tax In Malaysia

Malaysia Personal Income Tax Rates Table 2012 Tax Updates Budget Business News

Malaysia Personal Income Tax Relief 2022

10 Things To Know For Filing Income Tax In 2019 Mypf My

Tax Rate Lembaga Hasil Dalam Negeri Malaysia

Incorrect Pronunciations That You Should Avoid Learn English Pronunciation English Phonetics English

Iincametaxncome Tax Lhdn Filing Taxes Income Tax Tax Guide

Malaysia Personal Income Tax Guide 2022 Ya 2021

Malaysia Personal Income Tax Guide 2021 Ya 2020

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Malaysia Personal Income Tax Guide 2022 Ya 2021

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Brownies 1 Microwave Recipes Microwave Baking Tart Baking

Malaysia Income Tax Rates For Residents 2021 Table Asean Business News

Details Of 2 Agent Commission Withholding Tax L Co